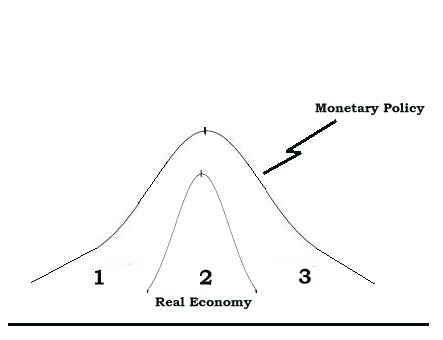

Current fiscal stimulus efforts mimic those of the great depression. FDR attempted to diddle the market by faking up liquidity in region #3 of the graph below. This region is the region where costs are artificially higher than the market economy can support. This attempt was implemented using wage controls that attempted to legislate wages at a higher than market price. He also tried government spending in an attempt to pump region #1 activity into region #2 but this can only overlay a phantom of region #1 activity in region #3 because in both cases the activities are marginal. This is the difference between deterministic math and probabalistic math. As probabalistic math is understood by a small fraction of the population politicians are thus able to sell their programs to the populace.

A real economy needs to operate in region 2. Bailout economies get stimulated in region 1 and subsequently pop to region 3 with only a very rapid passage through region 2.

Current bailout theory uses the second FDR method almost exclusively. It can be expected to yield the same results as FDR’s ill fated programs. Depression era programs has no essentially no effect. But why would that be?

The reason is that value is hard to create. If it were easy we would all be billionaires. The last person a sane person would expect to create value is a politician. Thus any stimilus schemes on the part of government will only result in market distortions. Stimulus acts should be looked upon as political juggling acts that can be pointed to when the politician is asked to do something.

0 Comments